will i get a tax refund if i receive unemployment

Heres a list of reasons your income tax refund might be delayed. According to the New Jersey Division of Taxation payments will sent beginning in late spring.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than 150000 on their 2020 tax return.

. Do you get a w2 from unemployment. Your tax return has errors. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Tax refunds on unemployment benefits to start in May. You reported unemployment benefits as income on your 2020 tax return on.

Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. IRS continues to review tax year 2020 returns and process corrections for taxpayers who paid taxes on unemployment. Heres What You Need to Remember.

If you received unemployment compensation you should receive Form 1099-G showing the amount you were paid and any. People might get a refund if they filed their returns. Reporting unemployment benefits on your tax return You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional.

When Will I Get My Unemployment Tax Refund. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Most states issue refunds.

The date you will receive your unemployment tax refund depends on your states refund schedule. You will get the additional refund if all of the following are true. You wont be able.

If your state conformed with the federal unemployment insurance compensation tax exclusion you may need to file an. Therefore if you received unemployment income in. Generally you have up to three years to file an amended return.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. Qualified renters income of 150000 or less will get a 450 rebate.

As a result jobless benefits up to 10200 for individuals earning less than 150000 per year are exempt from tax. It might take several months to get it. The amount of the refund will vary per person depending on overall.

Most recent status updated Sept 16 2022 IRS says. You filed for the earned income tax credit or additional child tax credit. The Internal Revenue Service recently announced that tax refunds on 2020 unemployment benefits are expected to start landing in.

Can you track your unemployment tax refund.

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Interesting Update On The Unemployment Refund R Irs

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Unemployment Refunds Moneyunder30

Taxes Q A How Do I File If I Only Received Unemployment

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Dor Unemployment Compensation State Taxes

Is Unemployment Taxed H R Block

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment 10 200 Tax Break Some States Require Amended Returns

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

When Will Irs Send Unemployment Tax Refunds 11alive Com

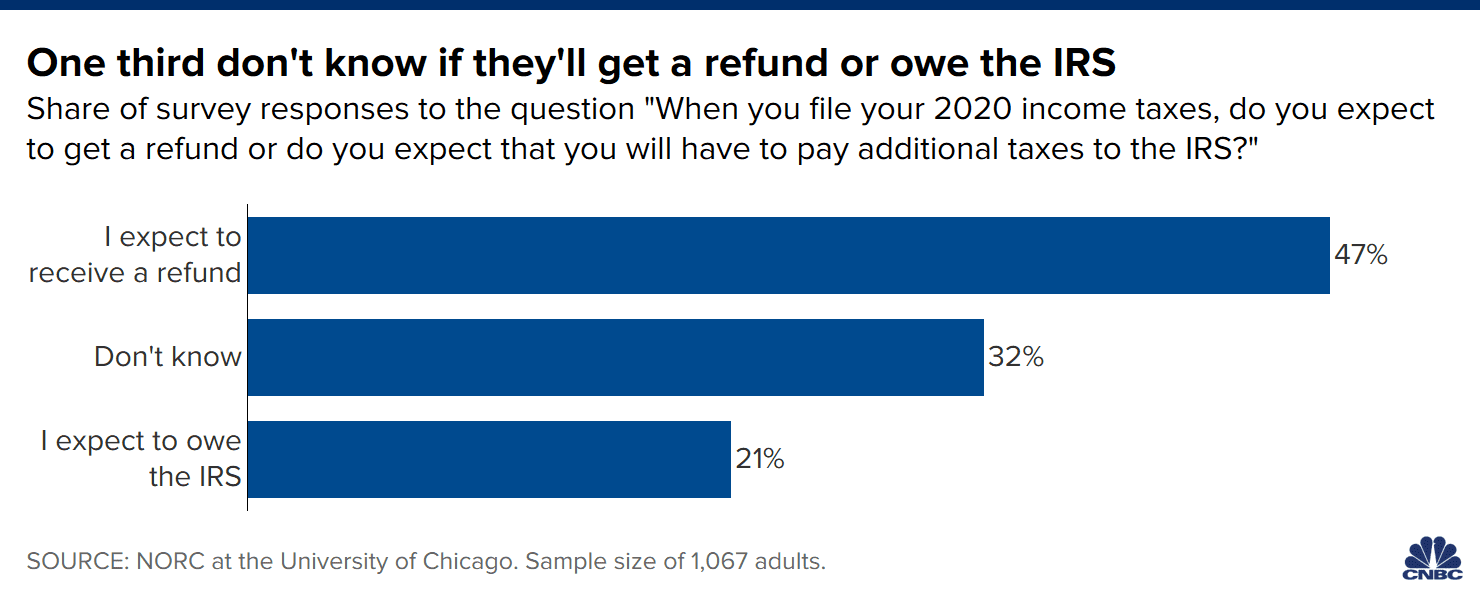

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings